When will the Secular Bear Market End?

The US stock market has been in a secular bear market since 2000. It will be difficult to make any money in stocks until this long term bear market ends. So, the question is when will the secular bear market we are currently experiencing end?

No one knows for sure, but history of the US stock market provides some signs that, if repeated, may indicate when the current bear market may end. I will provide some historical data for you to consider.

Secular Market Durations

Many stock market historians believe that long term market trends travel along a predictable timeline. The secular market trends of the last 80 years do seem to roughly support this view. These market historians believe that the secular direction of the market changes about every 17.6 years. Using February 2000 as the date of the last secular market change, the table below traces back the last four secular market changes. Each date in the table represents about 17.6 years before the date above it.

|

Date |

Dow Jones Industrial Average (DJIA) |

|

February 2000 |

11,700 |

|

July 1982 |

800 |

|

January 1965 |

900 |

|

April 1947 |

180 |

|

October 1929 |

380 |

Beginning at the bottom row of the table, the period from 1929 to 1947 included the great depression and was undoubtedly the worst secular bear market in our history. The DJIA was over 50% lower at the end of this 17 year period versus the beginning. The 17 year period from 1947 to 1965 was a secular bull market for the US stock market as the DJIA increased about 500%.

From 1965 to 1982 the DJIA started at about 900 and ended at about the same level. This 17 year period resulted in no stock market capital gain at all. This was a very difficult period for US stock investors as the country experienced significant inflation as well. From 1982 to 2000 the US stock market experienced the greatest bull market in history with the DJIA increasing almost 1500% during this period.

If this historical trend continues in our current environment, the end of our current secular bear market will arrive around late 2017.

There is no way of telling how long our current secular bear market will last. But given the developed world’s economic issues of slow growth, unsustainable deficits and debt, and high unemployment, despite record amounts of fiscal and monetary stimulus, I would be wary of any Wall Street fund manager who declares we are finally over the hump and are at the beginning of a new bull market. Sooner or later he or she will be right, but I think we are still a few years away from a sustained rise in the stock market.

Price/Earnings Ratio

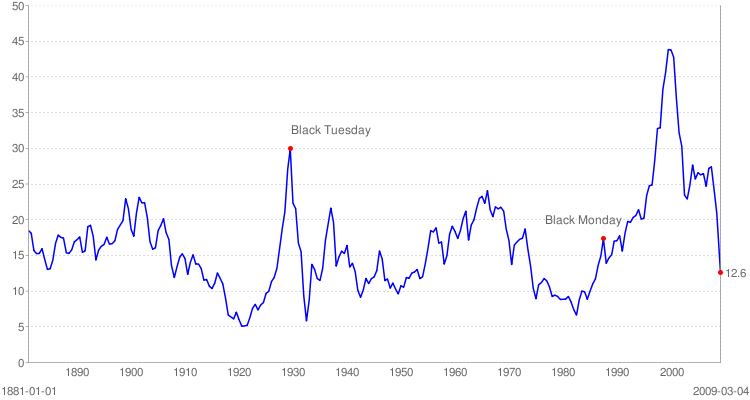

I think a better indicator about when the current secular bear market may be near an end is watching the aggregate stock market Price/Earnings (P/E) ratio. Below is a chart of the DJIA’s P/E ratio from 1881 to 2009. The data in the chart represents the average inflation-adjusted earnings from the previous 10 years, known as the Cyclically Adjusted PE Ratio (CAPE Ratio), as calculated by Yale University Economics Professor Robert Shiller.

Chart Source: www.ritholtz.com

The chart shows that the DJIA’s CAPE ratio in early 2000 was at an all-time high of about 44. At the beginning of the new secular bull market in 1982 the CAPE ratio was below 10. In 1965 the DJIA’s CAPE ratio was around 24, not exorbitantly high but above the long-term average of about 15. In 1947, the beginning of another long-term bull market, the CAPE ratio was again around 10. And in 1929 the DJIA’s CAPE ratio at the beginning of the great depression was about 30.

These historical P/E values at the stock market’s inflection points would seem to suggest that our current bear market will not end until we see an aggregate market P/E ratio at or below 10.The current (spring 2012) S&P 500 index P/E ratio as calculated by Robert Shiller is about 20.

Some market experts argue that a higher aggregate market P/E ratio is justified due to our current very low interest rate environment. If I were confident that interest rates would stay at the current levels, I might agree with the experts. But with the Federal Reserve’s current policy of injecting more and more liquidity into the market, I believe we are going to experience some inflationary pressures requiring interest rates to rise. If this happens, the aggregate stock market P/E ratio will contract.

I should point out that during secular bear markets there are cyclical (short-term) bull market rallies. We just experienced a very strong cyclical bull market rally from March 2009 to now when the DJIA doubled from about 6,500 to 13,000. The current 13,000 DJIA is higher than the index value of 11,700 at the beginning of the current secular bear market in 2000. This is not unusual. But the market indexes at the end of the bear market will always end up near the value at the beginning of the bear market.

So if we are in an equity bear market for another 5 years or longer, what is an investor to do? It is difficult to navigate a secular bear market that contains several bull market rallies. There is a temptation to try to be a market timer. I would not do this. What I have done and what I suggest most investors do is adopt a slightly more conservative portfolio. Specifically:

- I would dial back my equity allocation a bit from my normal age-appropriate allocation,

- I would focus on dividend paying stocks because, in long-term bear markets, returns from dividends are typically higher than from capital appreciation,

- In a secular bear market, portfolio re-balancing is more important than ever. This is the only way you will be able to capture some capital gains without becoming a market timer.

In long-term bear markets your focus should be more on capital preservation. When the aggregate stock market P/E ratio approaches 10, then it may be time to be more aggressive with your portfolio.

Did you enjoy this post? Why not leave a comment below and continue the conversation, or subscribe to my feed and get articles like this delivered automatically to your feed reader.

Comments

No comments yet.

Sorry, the comment form is closed at this time.